Sign up

Highlights - 02/05/2019

First year of mandatory remote voting for all companies

After the first year of adoption of remote voting by all category A companies with traded shares, B3 published a survey showing that the average quorum at meetings increased from 71% in 2016 to 78% in 2018. Of the 321 companies that held shareholders’ meetings in 2018, all of them eligible to receive remote voting, 64% received remote voting forms submitted through the different authorized channels.

The data were presented at the Remote Voting Workshop, held by B3 and Lobo de Rizzo in São Paulo this week. The recently announced interconnection of the B3 (Corporate Intelligence Center) system with Empresas.net will allow companies to prepare and send the remote voting form to both B3 and the CVM at the same time, directly through CI. CORP, without having to print a pdf of the system, save it as a document and then file it in Empresas.net, in the BdV category.

This measure is designed avoid version mix-ups, as companies sometimes sent a document via the system and posted a different version of the document on the website, which often created a conflict between the votes received through the company and those received through the bookkeeping agent.

It is important to emphasize that the main purpose of the voting form is to ensure shareholders’ rights, whether exercised in person at the meeting or not, i.e. those who submit their vote in advance should not have misleading information that may hurt decision-making. This is the mindset that should be adopted when preparing the voting form, as many questions can arise in the process.

In addition, companies must make sure that the information in the voting maps is clear, so that there is no conflict of information between what was voted on the map and what was accounted for in the meeting’s D0. Therefore, it is not advisable to change the order of questions, summarize information or exclude responses.

In the latest data available after the 2017 annual shareholders’ meetings, 98% of the votes received via custodian/depository agents – equivalent to approximately two-thirds of the remote votes – were from foreign shareholders, which shows the importance of remote voting as a tool to ensure more comprehensive shareholders’ rights and strengthen corporate governance in the Brazilian capital market. As the practice matures, both for shareholders and for the areas dealing with this matter within the companies, participation is expected to increase, as is the relevance of remote votes.

Originally published by Cássio Rufino and Isabela Perez

Market Monitoring - 06/08/2018

Check out the world’s first Investor Relations BOT

Over the past year, our product development and user experience team undertook a task that will change the way users and publicly held companies communicate. It is the world’s first IR BOT, a pioneering project you can check out on Cielo’s new IR website (ri.cielo.com.br), released this Thursday, June 7th.

Based on 20 years of experience and a portfolio of more than 1,250 developed websites, MZ has a very dense statistical material that allows us to understand different scenarios. We know, for example, the entire user navigation flow, from the time users access the website to the time they leave it, which – among other data – helps us identify what sections of the IR website appeal to users.

It is also worth mentioning that users’ needs are constantly changing, especially because our goal is not only to deliver the largest volume of data in the shortest possible time, but also to reduce the distance between what users are looking for on the website and where they can find it.

The BOT – in its First Phase – meets the three main demands of IR website users.

01 – SEARCH FOR DOCUMENTS:

We instantly find any document filed by the company, drastically reducing the time spent accessing the results center/download center, for example.

02 – SEARCH FOR MENTIONS IN DOCUMENTS

We find any mention in the stored documents (PDF). For example, if your name is mentioned in a document on the website (no matter how old), you can find it. You can also find all documents where a particular word is mentioned, including conference call transcriptions.

03 – CONTACT IR

It is another recurring demand for guidance and improvements, especially in companies with a large share of individuals in their shareholder base. Our virtual agent understands this request, helps users fill out the form and sends the information to the IR team.

04 – RANDOM AND SEASONAL QUESTIONS

Random and seasonal questions are also important features and our tool helps minimize their impact on the operational team. Institutional information on the CEO, the CFO, the company’s foundation, events that occurred at some point, or one-off needs on the decline or increase in the company’s market cap can be interpreted on the platform and because we use artificial intelligence and machine learning, the machine’s continuous learning process reinforces the assertiveness of the responses. The more it is used, the smarter it gets.

CUSTOMIZATION

Our solution allows companies to customize the virtual agent’s name, adopting a name that feels more familiar to their users, as is the case of Poupinha, the virtual assistant of Poupa Tempo. In addition, the colors of chat bubbles for user-BOT interactions may be changed to adhere to the customer’s visual identity. Greetings and instructions within the guided navigation can also be adjusted.

MZ’s new positioning – focus on technology/artificial intelligence/big data – directly benefits the capital market “ecosystem” and investor relations, in particular. We are proud to be the first movers in the BOT category and to have this technology as part of our innovation package for our current/new customers’ stakeholder relations as of today.

To give you an idea of the market engagement with chatbots, since 2014, companies using chatbots have increased their revenue by between 5% and 16% compared to their peers, according to a study by Tata Consultancy Services. It is estimated that companies that use chatbots to interact with their customers will save more than US$8 billion by 2022 – in the banking industry alone!

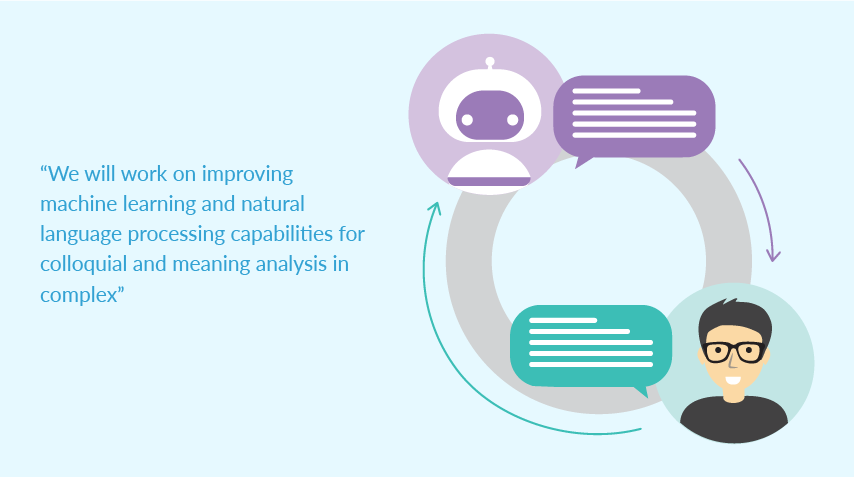

From now on, we will work on improving machine learning and natural language processing capabilities for colloquial and meaning analysis in complex, multi-step applications. Our roadmap includes integrations with other platforms so the company has a “virtual presence” in several places other than the website. The platforms under analysis include Slack, Facebook Messenger, Telegram, Twitter and Skype, among others. Wearables and the already popular Home Assistants will also be able to interact with users.

Count on MZ to integrate this new technology into your IR website. Your stakeholders will thank you.

___________________________________________________________

Eduardo Daolio is a Partner and Head of User Experience of MZGroup and has worked in the communications area since 1993.

Sector Report - 06/05/2018

The impact of MiFID II on IR day-to-day activities

The Markets in Financial Instruments Directive II (MiFID II) came into effect in the European Union on January 3, 2018, changing several financial market rules not only for EU member countries, but potentially for the whole world.

The more than 7,500 pages of the new legislation include two major points of interest for Investor Relations professionals: individual payment for research reports and corporate access. Until last year, it was common practice not to pay for research reports or the corporate access provided by brokers, as this cost was embedded in brokerage fees (bundle). MiFID II has changed this dynamic because it requires that these services be paid for separately, forcing the unbundling of the “brokerage + research + corporate access” package.

In practice, these two changes mean that investors have to review their budgets in order to adapt to the new reality. Regarding research, the size, scope and reach of sell-side research tends to decline, as the demand for research on large companies and market darlings should remain stable or fall, while the demand for small-cap and lesser-known companies should drop.

From the corporate access viewpoint, the frequency of roadshows and other events is expected to decrease. In addition to the aforementioned reasons, we must consider that neither investors (or potential investors) nor companies need an intermediary to be able to interact, although it is an undisputed fact that banks and brokers are great facilitators of this process.

Therefore, the IR team should face and be prepared for the following situations:

- Smaller reach of the message sent to the market through the sell side;

- Increased demand directly from investor or potential investors; and

- Reduced reach of roadshows and events organized by banks and brokers, such as reduced attendance and number of meetings.

Reach beyond the European Union

It is wrong to think that MiFID II applies only to European companies and investors. As mentioned above, the recent regulation of the European Securities and Markets Authority (ESMA) establishes that all those who have business or do business with the European Union are subject to it.

This means that, if an Italian bank has a branch in Argentina and this branch hosts a roadshow in a EU member country, it will be subject to the rules of MiFID II. If a Brazilian bank has a branch in Portugal, this subsidiary is subject to MiFID II. If an American broker has a customer in Germany, operations with that customer must comply with MiFID II standards. And so on.

In Brazil, when talking to several IRs of companies from various sectors with various market caps, we see there is not yet a uniform view of the impacts of MiFID II on day-to-day operations. Some have said that they have felt little or no difference in the behavior of analysts and investors since the implementation of the new rules in the European Union; others reported having already felt greater demand from investors, who have been asking for more calls and meetings (one reported to have received a request for a meeting between events he was attending in the US); while another reported that roadshows in Europe can no longer fill all their time slots.

However, regardless of the view of each IR team, it is undeniable that MiFID II has already changed and will continue to change the modus operandi of the financial market. Other countries are likely to adopt some of the measures set out in the new regulation in order to standardize their operations around the globe.

Originally published by Rafael Rosenberg.

Highlights - 05/25/2018

Why did we set up a product team?

Product teams are increasingly in evidence. It is very common for companies to have these teams, regardless of their size, industry or segment.

This article is the first in a series in which we will discuss concepts related to our product team. We will divide the subjects into:

Part I: Why did we set up a Product team?

Part II: How do we apply the MVP concept?

Part III: What influence does data really have on our strategic decisions?

Introduction

Before we begin to discuss our product team, it is worth making a small introduction on the company in which the team is inserted.

MZ is a leading company in the Brazilian investor relations sector. With 19 years of existence and a consolidated position in the market, our goal continues to fulfill our purpose entirely, which is to offer products and services that facilitate and increasingly add value to our customers’ daily investor relations responsibilities. Yet, we still perceived that we needed to undergo changes as we take our company forward.

With this need for change came the decision to prepare the Company for an increasingly fast and digital world and with this focus we began a digital and cultural transformation process. As part of this process, we designed the Company’s operations around the new products we are creating, investing in state-of-the art technology and changing the way we had been working until now.

One of the first effective actions we executed was the creation of our product team, which became responsible for our new positioning.

To understand what this change represents, it is essential to look at our past. During a long time, our teams were divided as follows:

Business Team: Responsible for identifying our clients’ needs and ensuring that they are met.

Technology Team: Responsible for maintaining existing products and developing new functionalities requested by the business team.

This operating model, which is widely used by several companies, has certain flaws, in which we highlight:

- The business team does not have the necessary knowledge of technology and this eventually leads to the creation of “phantom” products, which cannot be reused and will require future maintenance and incur costs for company.

- The technology team does not have a clear understanding of possible product growth, and therefore strategic decisions are rarely effective.

- Extensive documentation and difficulty of control: In an agile world, full of changes, delivery have to be quick. Transforming maintenance into megaprojects causes inconveniences to all parties involved (client and internal teams).

- Update Difficulty: The process of creating new tools and updating existing technologies is extremely difficult due to the existence of many business rules spread across all the applications that were built.

As we looked at this scenario, we realized it was extremely necessary to have tighter control over our products and to ensure that only effective and relevant functionalities were developed.

When analyzing the market and companies, we came across several operating examples, two of which caught our attention. Thus, and we decided to study them in depth and apply their operating model to our company: Spotify (Squads) and Google (OKRs).

Team Structure (Squads)

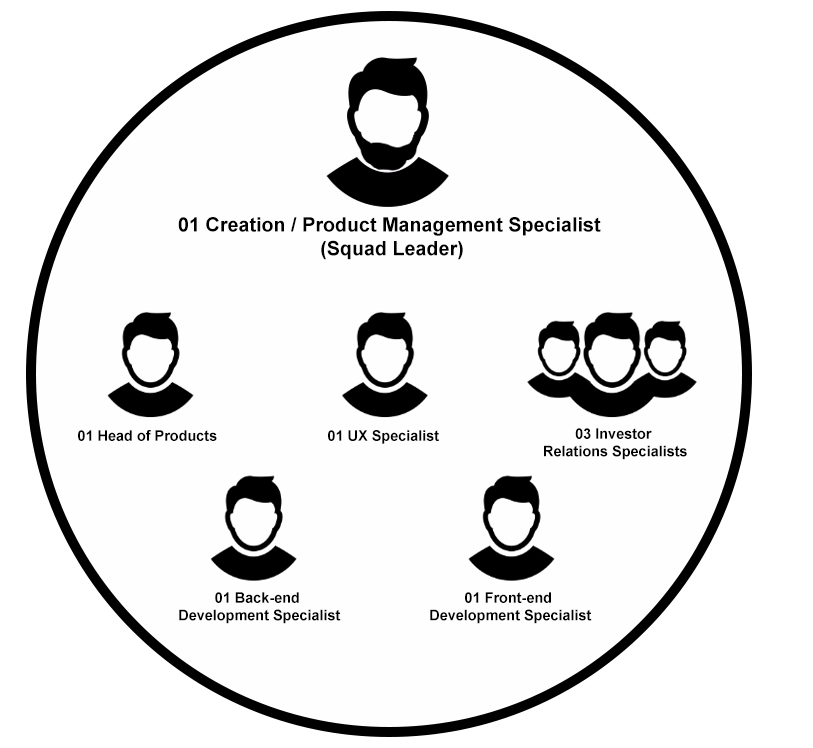

The basic requirement to achieve excellence is having professional with different qualifications working together for the same purpose. Therefore, we created a product team comprised of:

The main challenges of this team are to ensure that the development team produces only what will bring value to our clients, and that such products can be scalable and replicable, and analyze the data generated by the platform to make decisions about existing features (necessary changes or discontinuation).

The fact that we have a multidisciplinary team is fundamental for us to fulfill our objectives. We are able to analyze a product from end-to-end, understand if it can be created with the existing technology (technical specialists), if it will bring benefits to the market we serve (IR specialists), if it is well designed/structured and will be accepted (UX specialists) and if the timing for its launch is correct (leader).

Prototyping / Validation

There are many literatures on what a product team’s routine should be. We’ve chosen to follow the teachings provided by Google Ventures (GV), which can be found at this address: http://www.gv.com/sprint/

Our sprints, just like GV, are divided into five days. Each day has its specific routines and activities and at the end of the week (Friday), we either approve, or not, our idea. If it is approved, this functionality goes to the development team to be implemented.

In summary, new functionalities follow the principle that there is no need to implement them without previous validation. Therefore, we focus our efforts on discussing which business rules should be met and how best to serve them.

After defining what should be delivered, we create functional prototypes and validate them with clients and other experts. If we receive a 75% minimum approval from our target audience, we move forward.

The only rule that we do not strictly follow is the amount of time spent. According to GV, it is necessary to have, at least, 6 hours of daily focused work. Because we have a lean operation and other demands, we dedicate only a portion of our work day. Despite this, we did not feel this was a disadvantage and our development rework rate declined dramatically.

Measurement / Maintenance

For features that have already been developed and are currently in use, nothing is more assertive than data. We collect various information on use, time spent on each task, how easy it is to use, among other data.

Based on this data, we suggest changes (layout, flow of information or even business rules) and validate with our clients/internal audience before them.

The most incredible thing about working with data is that, in over 95% of the situations, the suggested changes are very well accepted and complimented. With this, we spend less time correcting bugs and invest it more wisely towards the creation of new features.

Analyzing data, however, do not mean we do not need to interact with our clients. It is always very important to listen to the client and validate their requests. To achieve this, we use Google Forms, a feedback tool with four questions. These questions allow us to better structure requests/suggestions, avoiding the traditional “what if…” method, and changing an uncertain suggestion for something that will really bring value to the requesting party.

Conclusion

The world is changing. New technologies emerge as we speak and we need to be prepared to achieve excellence by using what is most modern out there. It is impossible to innovate, improve and evolve if we are stuck in old and outdated processes. Creating a team of products like ours can streamline and ensure the necessary speed for the necessary evolutions and adjustments.

It is also important to point out that collecting data on any implementation is highly important. We’ll discuss more on that in the third article of this series.

Our next article will be on how we use the MVP concept and how it helped us save hours and hours in product development.

Authors: Felipe Furlan

Sector Report - 10/30/2017

Public Tender Offers in a scenario of economic deterioration and currency devaluation

In 2013, I wrote an article talking about the different types of Tender Offers and the need for companies to transcend the legal requirements and develop a well structured communication program in order to ensure equal treatment for all shareholders. At the time, I highlighted the Public Tender Offer for the delisting of companies and discussed cases such as CCDI, Redecard and Amil. Since then, there have been a few more current examples, so I’ve decided to take another look at the subject.

Economic deterioration and currency devaluation scenario

With the deterioration of the economic outlook, stock prices have fallen and, with the Brazilian currency devaluating, assets are much more attractive to overseas controlling shareholders and foreign investors. Therefore, in 2015, the subject regained momentum with the Souza Cruz Tender Offer, which restarted the intensification of the delisting of Brazilian companies.

Case – Public Tender Offer for Souza Cruz

Souza Cruz was listed on the stock exchange since the 40s and was a market leader among publicly traded Companies as one with the best dividend yield. The bidder was British American Tobacco (BAT), its controlling company, of British origin, and which held more than 75% of Souza Cruz’s capital stock. BAT’s decision was most likely determined taking into consideration the following factors:

- Souza Cruz’s great cash generation capacity;

- The price of the Company’s shares; and

- Favorable exchange rate.

The intention of the Tender Offer was announced in February 2015, but after re-evaluation requested by the minority shareholders, BAT increased the value of the offer, and with this, Souza Cruz’s capital stock closing auction was held on October 15, 2015 and more than US$2.4 billion was handled in the operation, representing nearly US$1 billion of savings to the British company, compared to what would have been spent if the bid had been made in February. The result was positive for BAT due to the devaluation of the Brazilian currency, nullifying the increase in the price offered for the shares.

Offers in Analysis

In addition to foreign controllers, the economic scenario is also drawing the attention of Brazilian controlling shareholders of companies listed on BM&FBOVESPA.

Currently, 14 Takeover Bids are being analyzed by the CVM (Securities and Exchange Commission), and 12 are for the delisting of the companies.

We have, today, an outlook in which several companies’ market capitalization are below their book value. This means that, in addition to the large amount of share buyback programs (more than 70 Companies have launched buyback programs since 2015), controller shareholders are also choosing Public Tender Offers for companies delisting. Currently, 14 Public Tender Offers are being analyzed by the CVM (Securities and Exchange Commission), and 12 are for the cancellation of listed company registrations.

Below is a list of the 12 Companies for which delisting Tender Offers are being analyzed by the Securities and Exchange Commission:

Strategic decision

As I previously said in the 2013 article, as well as an IPO, the decision of the Tender Offer involves a series of evaluations of the advantages and disadvantages of the company to remain listed on the stock exchange. The delisting is seen as an opportunity for the financial and strategic management of the controlling shareholder. The costs of maintaining the publicly-held Company (CVM, BM&FBOVESPA, auditing, legal publicity, etc.) and the necessary efforts to comply with specific legislation may weigh on the decision and nothing prevents the Company from returning to the market in the future. Therefore, with the negative outlook for the Brazilian economy, we will probably see a few more offers taking place.

João Marin

Inicialmente publicado em: João Marin – LinkedIIn

mzfelipepetricioni

Front-End Developer in MZ